Consumers crave convenience and flexibility. This desire has given rise to the “Buy Now, Pay Later” (BNPL) phenomenon, which is transforming how people shop. BNPL services allow customers to purchase items immediately and pay for them over time, often without interest or fees. This payment option is gaining immense popularity, especially among younger consumers who prefer its flexibility over traditional credit options.

What is Buy Now, Pay Later?

Buy Now, Pay Later is a type of short-term financing that allows consumers to make purchases and pay for them in installments over time. Unlike credit cards, BNPL typically offers interest-free periods, making it an attractive option for those looking to spread out their payments without incurring additional costs. Various companies provide BNPL services, and each has its own terms and conditions. However, the core idea remains the same: making purchases more manageable and accessible.

How Does Buy Now, Pay Later Work?

The process is straightforward. When shopping online, customers select the BNPL option at checkout. They are then required to provide some basic information, such as their name, email, and payment details. The BNPL provider runs a quick credit check, which usually doesn’t impact the customer’s credit score, and approves or declines the request within seconds. Once approved, the customer pays a portion of the total amount upfront and agrees to pay the remaining balance in installments over a specified period.

Benefits of Buy Now, Pay Later

- Flexibility: BNPL allows consumers to spread out the cost of their purchases over time, making it easier to manage their finances.

- Interest-Free Periods: Many BNPL providers offer interest-free periods, making it a cost-effective alternative to credit cards.

- Easy Approval: The approval process for BNPL is typically quick and straightforward, with minimal impact on credit scores.

- Increased Purchasing Power: BNPL can enable consumers to purchase higher-priced items that they might not be able to afford upfront.

- Convenience: The ability to manage payments through a simple online portal makes BNPL a convenient option for many shoppers.

The Rise of Buy Now, Pay Later in Fashion Retail

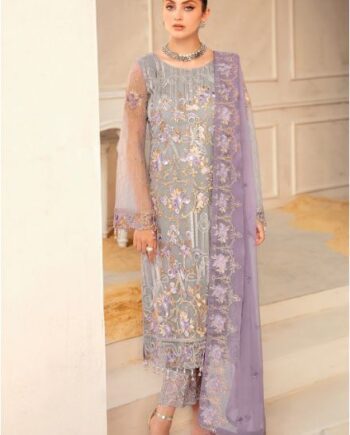

The fashion industry has embraced BNPL services with open arms. Retailers are keen to offer customers flexible payment options that enhance their shopping experience. Leading brands and online stores now provide BNPL options at checkout, allowing fashion enthusiasts to buy the latest trends without financial strain.

For instance, the Khaadi Latest Collection offers shoppers the opportunity to purchase their favorite designs now and pay over time. Similarly, consumers can buy Maria B Stitched Suits Online or explore the Asim Jofa New Collection using BNPL services, making high-end fashion more accessible.

BNPL and Online Shopping

BNPL services are particularly popular in the online shopping space. With the convenience of shopping from home and the added flexibility of spreading payments, consumers are more inclined to make online purchases. Websites offering Chiffon Dresses Online or Printed Lawn Suits see increased sales and customer satisfaction when BNPL options are available.

Challenges and Considerations

While BNPL offers numerous benefits, it’s essential to be aware of the potential challenges and considerations:

- Overspending: The ease of making purchases with BNPL can sometimes lead to overspending. Consumers should be mindful of their budgets and avoid buying items they cannot afford.

- Late Fees: Missing a payment can result in late fees, which can quickly add up. It’s crucial to understand the terms and ensure timely payments.

- Impact on Credit Score: While initial credit checks for BNPL usually don’t impact credit scores, missed payments can. Responsible use of BNPL is essential to maintain a good credit rating.

- Limited Availability: Not all retailers offer BNPL options, so consumers may need to check if their preferred stores support this payment method.

The Future of Buy Now, Pay Later

The popularity of BNPL is expected to continue growing, with more retailers and consumers adopting this flexible payment option. Innovations in technology and financial services will likely lead to even more streamlined and user-friendly BNPL experiences. As the market evolves, we can expect to see new features and options that further enhance the convenience and accessibility of BNPL.

For example, the Ramsha Latest Collection might offer integrated BNPL options directly within their shopping app, allowing for seamless transactions. Similarly, advancements in artificial intelligence could personalize BNPL offers based on individual shopping habits and preferences.

Conclusion

Buy Now, Pay Later is revolutionizing the shopping experience by providing consumers with a flexible, convenient, and often cost-effective way to make purchases. Its rise in popularity, particularly in the fashion industry, highlights the demand for more accessible payment options. As BNPL continues to evolve, it promises to make shopping even more enjoyable and stress-free for consumers worldwide.

Whether you’re purchasing the Khaadi Latest Collection, exploring Chiffon Dresses Online, or buying Printed Lawn Suits, BNPL can make your shopping experience smoother and more manageable. As long as consumers use BNPL responsibly and stay within their budgets, this payment option can be a valuable tool in their financial arsenal.

-

Maria B Stitched saree Couture Red MC 051 LATEST Collection 2024$125.00 – $159.99

Maria B Stitched saree Couture Red MC 051 LATEST Collection 2024$125.00 – $159.99 -

Maria B Stitched MBROIDERED Burnt Orange Fuchsia Pink (BD-2506)$140.00

Maria B Stitched MBROIDERED Burnt Orange Fuchsia Pink (BD-2506)$140.00 -

Maria b MBROIDERED Stiched Organza Grey and Black Saree (BD-2504)$299.99

Maria b MBROIDERED Stiched Organza Grey and Black Saree (BD-2504)$299.99 -

Party Wear Organza Embroidered Wedding Collection 2024$120.00 – $150.00

Party Wear Organza Embroidered Wedding Collection 2024$120.00 – $150.00 -

Asim Jofa embroidered Stitched Lawn Printed Suit$60.00 – $85.00

Asim Jofa embroidered Stitched Lawn Printed Suit$60.00 – $85.00 -

Maria B Stitched Ice Blue Saree Latest Collection 2023$170.00

Maria B Stitched Ice Blue Saree Latest Collection 2023$170.00 -

Maria B Stitched Saree Couture Pale Pink MC 050$159.99

Maria B Stitched Saree Couture Pale Pink MC 050$159.99 -

Pakistani Wedding Collection saree 2024$199.99

Pakistani Wedding Collection saree 2024$199.99 -

RAMSHA F-2210 STITCHED CHIFFON COLLECTION 2023$100.00 – $120.00

RAMSHA F-2210 STITCHED CHIFFON COLLECTION 2023$100.00 – $120.00